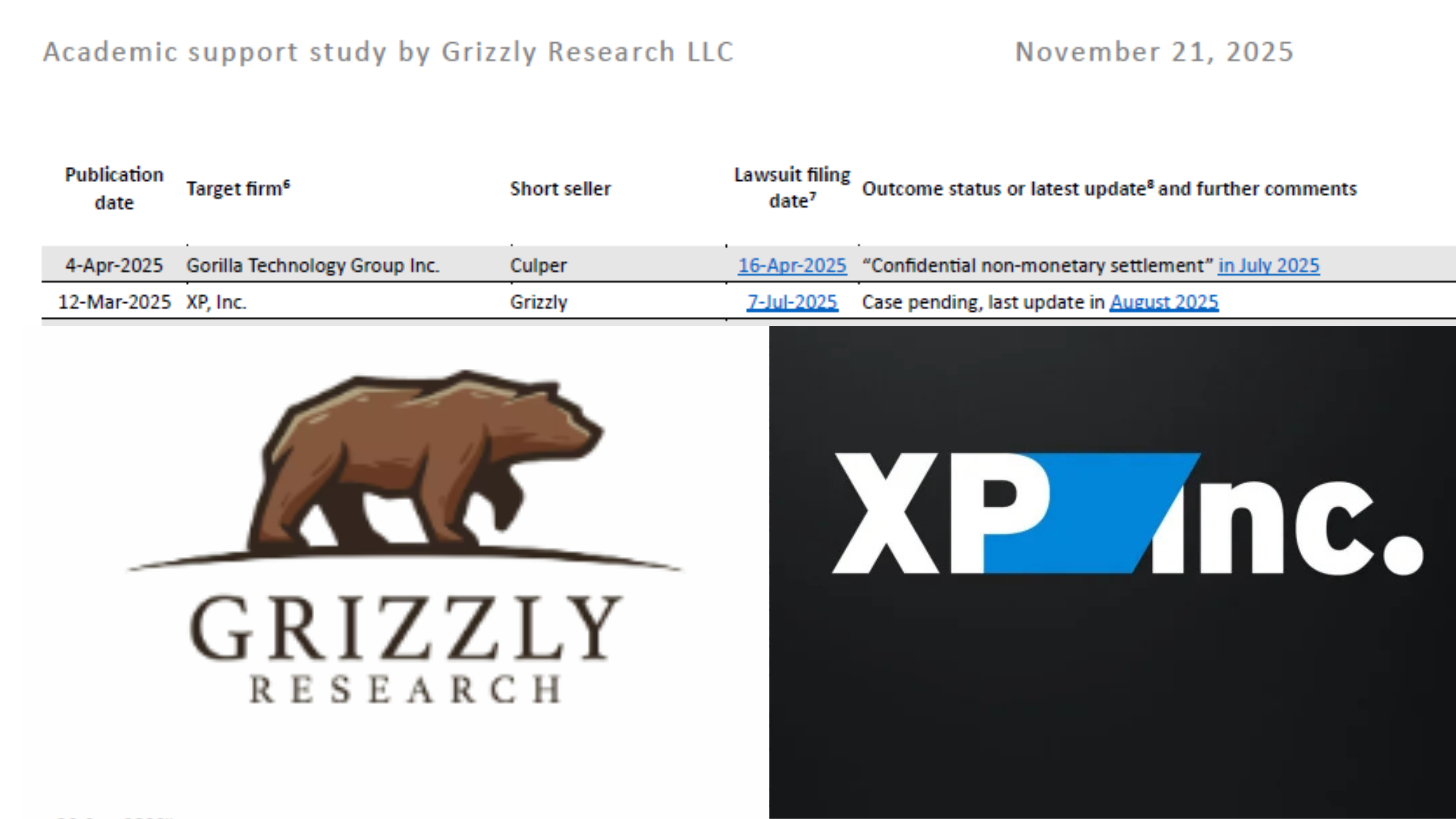

By Brazil Stock Guide – The dispute between XP Inc. (NASDAQ: XP, B3: XPBR31) and Grizzly Research has entered a new round after the New York–based activist firm published a study linking lawsuits filed by companies against short sellers to significant long-term underperformance. The report, released on November 21 and listing XP among the 24 cases analyzed, revived tensions that began in March, when Grizzly described XP’s practices as resembling a “Ponzi scheme” — an allegation XP rejected as false and defamatory.

Grizzly’s New Study

The study argues that companies suing activist analysts tend to underperform the S&P 500 by 72% over the long run. According to Grizzly’s dataset, none of the companies that filed lawsuits against short sellers outperformed the index. CEO Siegfried “Siggy” Eggert says the purpose of the study is to defend freedom of expression and increase transparency, adding that “we have heard that Brazilian media outlets who dare to discuss XP critically were pressured to retract negative reporting.” He maintains that the publication is meant to explain a broader structural pattern rather than escalate the dispute.

We have heard that Brazilian media outlets who dare to discuss XP critically were pressured to retract negative reporting.

XP in the Study

XP appears as a recent case in the sample. According to Grizzly, from its March report to August 2025, XP shares rose 9.4% in absolute terms but underperformed the S&P 500 by 2.3%. After litigation began, Grizzly estimates an additional 16% drop. The firm argues that this trajectory mirrors the pattern observed in other disputes.

Eggert told Brazil Stock Guide that “we have not changed our opinion on XP,” reaffirming confidence in the accuracy of the March allegations. He noted that Grizzly and its affiliates held short positions in XP at the time the study was published — a strategy in which the investor sells borrowed shares and profits if the price falls.

The methodology, however, compares XP to companies that were delisted, bankrupt or facing severe operational distress well before their disputes, without sector-specific or regulatory adjustments, according to an expert consulted by Brazil Stock Guide. This broad grouping strengthens Grizzly’s thesis but produces asymmetric comparisons.

Who Is Grizzly Research

Founded in 2019 in New York by Siegfried “Siggy” Eggert, Grizzly Research is an activist short-selling outfit known for aggressive reports and for pairing negative theses with short positions. The model can create conflicts of interest and is often scrutinized by regulators. The firm has built visibility but also drawn criticism for methodological choices in several investigations.

XP’s Response

XP rejected the study and said Grizzly continues to promote claims already disproven in legal proceedings. In a statement to Brazil Stock Guide, the company said: “As XP stated in March, legal measures have been taken in both Brazil and the United States, and the company maintains full confidence in the judiciary. The information released by the research firm, both in March and in November, not only distorts the facts but also reflects a persistent attempt to sustain narratives already disproven in ongoing proceedings. XP reiterates its commitment to integrity and to the trust of its clients and remains confident that the competent authorities will continue to bring the truth to light.”

Banco Master Tension

The study resurfaced as the liquidation of Banco Master, led by Daniel Vorcaro, renewed scrutiny of retail product distribution. XP was the largest distributor of Master’s high-yield CDBs, which offered 150% of the Selic rate and were backed by Brazil’s Deposit Guarantee Fund (FGC). XP distributed roughly R$ 26 billion of the R$ 41 billion issued — a volume that consumed about one-third of the FGC’s available funds.

Asked about the connection referenced in the statement posted on its website, Eggert said that recent Brazilian reporting suggests “the role XP appears to have played in the Banco Master situation is concerning and connects directly to the issues we outlined in our report.” On whether this exposure increases Grizzly’s own legal risk, he responded: “Ultimately only regulators have the power to intervene. Public reporting is key to increasing transparency and raising important questions.”

Market Impact

Grizzly’s first report triggered sharp volatility: XP shares fell 8% intraday and closed down more than 5%. In the following weeks, the stock stabilized and recovered part of the losses, supported by operational results, including revenue growth, customer expansion and a broader product offering.

Legal Battles

In the U.S., the Federal District Court in Delaware granted XP’s request under Section 1782, allowing the company to seek documents and testimony from Grizzly. The research firm confirmed it had been notified and said it filed a motion to vacate or quash the request as excessive and unfounded.

In New York, Grizzly filed a motion to dismiss along with an anti-SLAPP claim — a legal tool designed to block lawsuits considered abusive against speech on matters of public interest. The firm argues XP is attempting to “punish and intimidate independent investigation.”

In Brazil, XP is pursuing a criminal investigation handled by external counsel and maintains that Grizzly’s allegations “have already been disproven in the case files.”

No Sign of Settlement

Asked about revising its report, negotiating a settlement or issuing a partial retraction, Grizzly was unequivocal: “We intend to vigorously defend against XP’s claims, which we believe are without merit.”

The firm did not comment on whether it has the financial capacity to endure a dispute that could reach US$ 100 million, and signals it intends to continue defending its work publicly, with no plan to step back.

Leave a Reply